Liquidity Providers

Yield earning opportunities within Wavelength

How do Liquidity Providers earn yield?

When a trade executes in a pool, the pool collects a trade fee. The trade fee is denominated in the input token. Each pool has its own set trade fee based on the underlying assets.

The Protocol Fees for trades will be collected as a percentage of the trade fees already being collected (a fraction of a fraction). From the traders' perspective, there is no price increase.

How do I get my trade fees?

If you are a Liquidity Provider for a given Liquidity Pool, as the pool collects fees, you automatically receive your share in the form of $WAVE tokens.

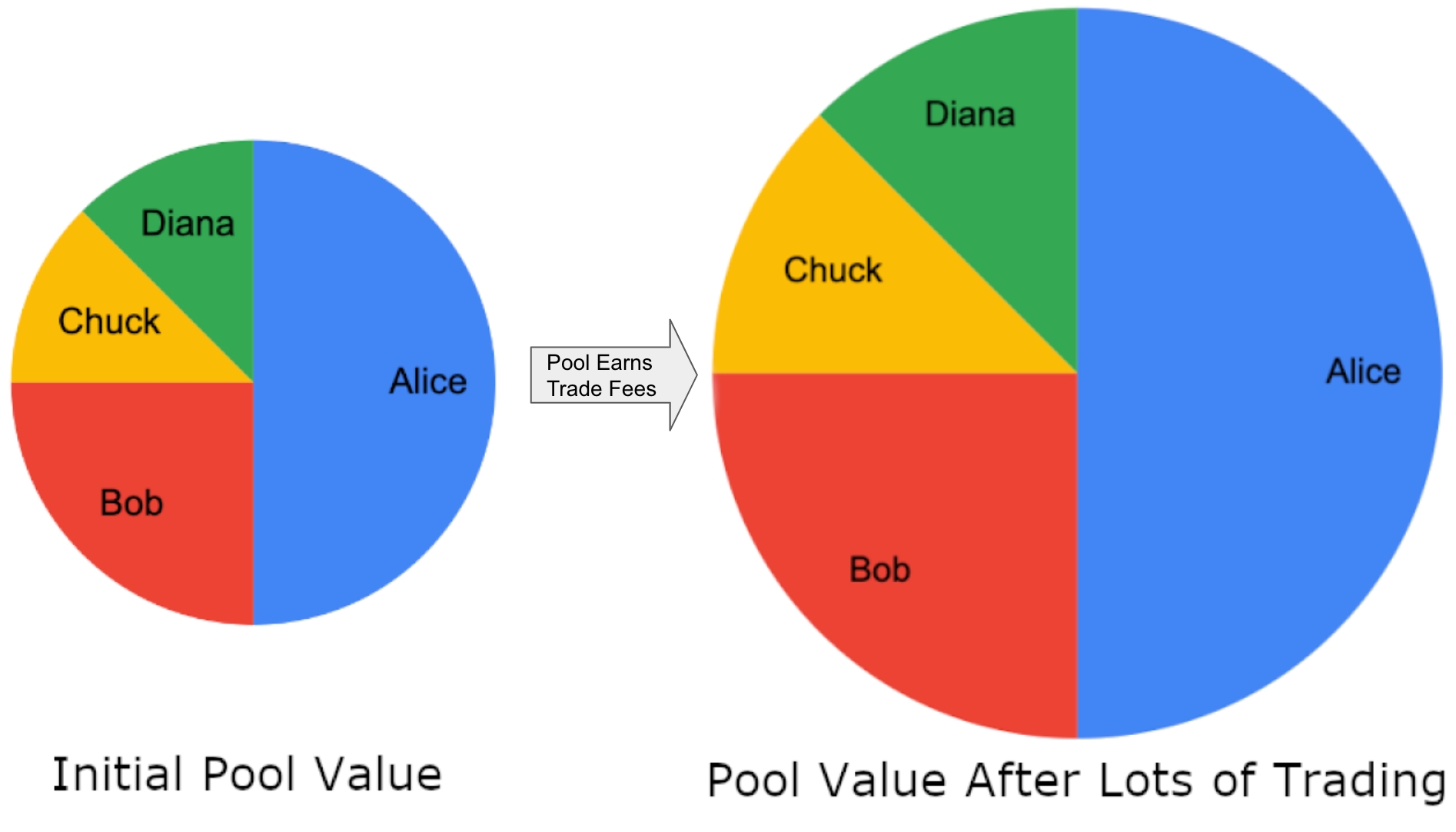

Trading fees are paid out pro-rata to Liquidity Providers, which means each LP receives a percentage of the fees that is equivalent to their share of the total liquidity in the pool. An example will be provided below.

Let's say Alice, Bob, David, and Diana all provide liquidity to the same pool. We will assume that they are the only LPs of this pool and the total liquidity in it is $100. If all three LPs take 100% of their fees and deposit them back as liquidity, the pool will indeed grow in size but their shares of the pool’s liquidity will remain unchanged.

| Person | Proportional Share | Initial Value |

|---|---|---|

Alice | 50.0% | 50$ |

Bob | 25.0% | 25$ |

Chuck | 12.5% | 12.5$ |

Diana | 12.5% | 12.5$ |

How does a pool determine the price of tokens?

In general, the AMM logic determines the prices that traders pay. For example, Weighted Pools use a constant product formula and Stable Pools use a StableSwap formula.

How does the self-balancing index fund work?

Wavelength allows for the creation of self-balancing index funds. Instead of paying a portfolio manager to continuously rebalance the fund, as investors do with an ETF, liquidity providers collect fees as traders rebalance the trading pools.

This works because market actors are incentivized to rebalance the portfolio to capture arbitrage opportunities.

Last updated